- The Modern Accountant

- Posts

- The Modern Accountant Weekly Newsletter | M&S’s Strawberry Sandwich Sparks VAT Drama 🍓

The Modern Accountant Weekly Newsletter | M&S’s Strawberry Sandwich Sparks VAT Drama 🍓

Plus:📣 Join Modulr's webinar - "Debunking Automation Myths in Accounting"

Welcome to The Modern Accountant, a must-read for entrepreneurial accountants in growing firms. Each week, we share expert insights and practical tips to help you scale your practice, expand advisory services, and embrace new opportunities. Let’s redefine the future of accounting together.

Editors Pick 📣

Join Modulr on Thursday, 17 July for a 40-minute live webinar as we tackle the biggest myths holding firms back from growth. Backed by fresh industry research, we’ll explore why many accounting firms misunderstand automation, and how modern payment systems can free up time, improve client outcomes, and unlock new revenue streams — like strategic advisory and fractional CFO services. |

Sector Spotlight 🌟

FINANCIAL GUIDANCE

In response to changing UK capital market dynamics, ICAEW has unveiled four principles to redefine the role of reporting accountants. These principles are designed to align independent assurance practices with evolving market demands while fostering economic growth and enhancing London's stature as a prime listing hub. At the heart of these guidelines is the emphasis on balancing investor trust with proportionate assurance, ensuring consistency in assurance processes both before and after IPOs.

A crucial facet of these proposals is their commitment to maintaining robust scrutiny levels, as independent verification is a cornerstone of investor confidence. With the UK Corporate Governance Code's updates and the Financial Conduct Authority's modernised guidelines, the ICAEW stresses that any reduction in scrutiny could expose new firms to increased risk of post-IPO corrections. Hence, thorough independent assurance and clear reporting processes are pivotal in preserving both investor confidence and the UK's capital market credibility.

VAT COMPLEXITY

M&S's new Strawberries & Creme Sandwich has sparked a VAT conundrum. Inspired by the Japanese fruit sando, it tantalises taste buds while confounding tax laws. Whether it's viewed as a sandwich, confectionery, or cake could significantly sway its VAT rating, from 0% to 20%, subsequently impacting price and margins. According to VAT rules, food not served through catering is generally zero-rated, except for confectionery—yet cakes are exempt unless chocolate-covered. The sandwich's classification thus becomes pivotal in defining its tax status.

The intriguing debate presents yet another chapter in ongoing VAT treatment disputes, reminiscent of the famous Jaffa Cakes saga. Ed Saltmarsh from the ICAEW underscores the complexity of VAT legislation, advocating for a revamp akin to international practices in countries like New Zealand and Singapore. This scenario not only highlights pivotal tax issues but also aligns with ICAEW's campaign to modernise and simplify the VAT framework. Thus, it’s a reminder of the delicate, yet invaluable, balance between creative consumer products and intricate tax regulations.

Retail Gazette

TAX COMPLIANCE

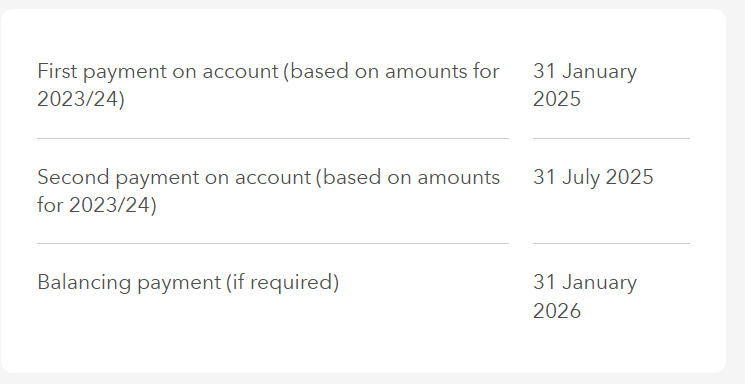

Taxpayers are reminded of the upcoming deadline on 31 July 2025, for making a second payment on account (POA) for the 2024/25 tax year. Generally, payments are split into two, each 50% of the previous year's total self-assessment income tax and Class 4 National Insurance Contributions (NIC) liability. A balancing payment may be due by 31 January following the tax year. It's crucial to check online or on self-assessment statements to see if a POA is necessary, as not everyone has to make one.

Before settling the POA, consider whether you can claim a reduction, especially if your taxable income for 2024/25 is expected to be lower. This can help avoid overpayments, as illustrated by Abigail's example, where she effectively reduced her payment by reassessing her liability. Nevertheless, late payments or incorrect claims can incur interest and penalties. Also, fiscal drag might increase taxpayers required to make POAs due to unchanged personal tax thresholds.

ICAEW - Key Dates for Tax Year 2024/25

AUDIT OVERSIGHT CONCERNS

The FRC has highlighted a significant oversight in the UK's largest accountancy firms, particularly regarding the unmonitored use of AI technologies in audits. While these firms, including the Big Four, have integrated AI for tasks like transaction analysis and contract reviews, they lack a structured assessment of AI's impact on audit quality—a concerning gap considering the potential ethical and accuracy risks. Only one firm reportedly tracks key performance indicators for AI's contribution to audit effectiveness.

Amidst ongoing scrutiny over audit failings, the lack of clear oversight raises questions about the responsible deployment of AI tools. The FRC urges firms to define performance measures, stressing the importance of ethical standards to maintain public trust. With EY investing $2bn for audit improvements post-Wirecard scandal, there's pressure to ensure the tech aids rather than hinders audit integrity, echoing the need for a balanced approach in marrying technology with robust audit practices.

TAX POLICY

Scotland's tax landscape has evolved significantly since the Scotland Act 2016, with a mixture of devolved, partially devolved, and UK-assigned taxes creating a complex scenario. While Revenue Scotland handles certain taxes like the Land and Buildings Transaction Tax (LBTT) and Scottish Landfill Tax, the control over income tax remains shared with the UK. This shared management leads to different tax rates and bands, affecting taxpayers differently in Scotland compared to the rest of the UK. Notably, Scottish taxpayers with incomes above £30,318 pay more income tax than their counterparts elsewhere due to differing thresholds.

The divergence in tax structures highlights the need for better public understanding. Surveys indicate low awareness of devolved taxes, suggesting a need for educational efforts by the Scottish government. Excitingly, future changes such as the introduction of the Scottish Aggregates Tax and potential local tax reforms reflect an ongoing evolution, promising a dynamic yet potentially perplexing tax environment.

iStock_shaiith_scottish_landscape