- The Modern Accountant

- Posts

- The Modern Accountant Weekly Newsletter | 💸 New VAT Relief for Charity Donations? ICAEW Says Yes

The Modern Accountant Weekly Newsletter | 💸 New VAT Relief for Charity Donations? ICAEW Says Yes

Plus: 📊 Excel shortcuts every accountant should know

Welcome to The Modern Accountant, a must-read for entrepreneurial accountants in growing firms. Each week, we share expert insights and practical tips to help you scale your practice, expand advisory services, and embrace new opportunities. Let’s redefine the future of accounting together.

Editors Pick 📣

In Modulr’s latest research, 75% of firms reported increased demand for business strategy advice. But only a minority have positioned themselves to meet it.

The compliance era is fading fast. To stay indispensable, entrepreneurial accountants are stepping into Fractional CFO roles, pairing sharp financial insight with the power of automated payment rails. Modulr’s new Fractional CFO Playbook shows how to swap time-based tasks for high-value partnerships, deepen client relationships and open fresh revenue streams. Modern businesses demand more from their accountants.

Your essential guide to:

Transitioning from compliance-based services to strategic roles.

Overcoming operational bottlenecks caused by outdated payment systems.

Delivering high-value services like payroll, forecasting, and cash flow management.

Sector Spotlight 🌟

PROFESSIONAL SERVICES

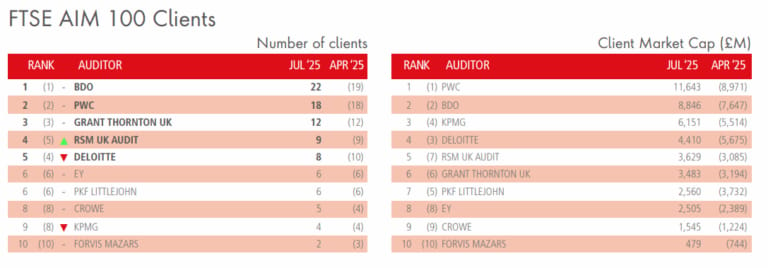

In the shifting landscape of UK audit firms, PwC has emerged as the frontrunner in client market capitalisation in the FTSE AIM 100, overtaking BDO. This change underscores the importance of high-value clients over sheer client volume. PwC's recent win with Greatland Resources played a pivotal role in this transition. Interestingly, while BDO retains strength in the Technology, Financials, and Consumer sectors, its growth this quarter was outpaced by PwC. PKF Littlejohn remains unrivalled in client count, boasting significant presence in Basic Materials and Energy sectors.

Meanwhile, Moore Kingston Smith has capitalised on its merger with Shipleys, leading to significant rank improvements. This trend of mergers is witnessed across mid-tier firms, as Cooper Parry Group and S&W also advance in rankings. Such shifts reveal an evolving market where mid-tier firms, relying on niche expertise and strategic mergers, are beginning to challenge the status quo set by the Big Four. Regulatory pressures continue to influence auditor strategies, with the ACCA prompting the Financial Reporting Council to adopt a balanced approach for SMEs.

Accountancy Age

TAX RELIEF POLICY

ICAEW is actively shaping the landscape of VAT relief for donated goods in response to the UK government's consultation. While ICAEW typically steers clear of expanding VAT reliefs, it's recognising the necessity in this instance and pushing for implementation that's practical and uncomplicated. By advocating for relief limited to donations from charitable entities and endorsing a certification system, they aim to simplify the process for donors without adding unnecessary strain. Critically, they advise against setting value thresholds or categorising eligible goods, recognising the potential complexity and rigidity this could introduce.

A focal point of ICAEW’s recommendations is their caution against imposing limitations based on the characteristics of recipients or how goods are utilised. Such measures, they argue, risk complicating the system and inadvertently excluding genuine charitable activities. Through their thoughtful input, ICAEW illustrates a commitment to streamlining VAT processes while protecting the interests of charities and ensuring that the relief actually serves its intended purpose.

TAX STRATEGY

Tech CFOs are transforming indirect tax from a cumbersome burden into a strategic advantage. Traditionally perceived as a cost centre, indirect tax is now seen as a gateway to efficiency, growth, and risk management. By modernising outdated systems and abandoning manual processes, finance leaders are leveraging intelligent automation for data extraction, validation, and compliance across multiple jurisdictions. This shift from spreadsheets to cloud-native platforms not only minimizes the risk of audits and errors but also aligns tax operations with broader business objectives.

Emphasising data centralisation, tech companies are integrating tax systems with core business platforms. This integration creates a single, reliable source of truth, streamlining compliance and empowering strategic decision-making. The modern approach also addresses the talent squeeze by automating repetitive tasks, allowing tax professionals to focus on strategic analysis rather than manual chores. For tech firms eyeing global expansion, scalable tax technologies enable compliance with ever-evolving rules, ensuring risks don't overshadow growth ambitions.

EXCEL EFFICIENCY TECHNIQUES

Excel users who aim to unlock its full potential might benefit from Simon Hurst's expert insights. Emphasising structured learning, Hurst advocates for professional training rather than relying on patchy web searches or AI, which often yield temporary fixes. Notably, mastering Excel’s lesser-utilised features, such as the F4 function key and Ctrl-Shift-V shortcut, can streamline processes significantly. Press above to learn more.

TAX COMPLIANCE TOOLS

Avalara's introduction of AI assistant Avi is designed to demystify the convoluted realm of U.S. tax compliance. Integrated within Avalara Tax Research, Avi offers instant, authoritative answers to tax queries, particularly useful for businesses navigating the complex U.S. tax environment. By enabling tax managers like Bill from Microsoft to determine if specific transactions are taxable, Avi simplifies research tasks and provides citation-supported responses, enhancing operational efficiency.

Avi stands out by being specifically trained on Avalara’s extensive tax content, distinguishing it from more generic AI tools. While not foolproof and reliant on clear user queries, Avi enriches the tax research process without replacing professional judgment, a feature emphasised by Avalara's chief strategy officer, Jayme Fishman. The AI's intuitive design not only supports U.S.-centric tax scenarios but aims to expand globally, potentially integrating into accounting systems. This approach aids professionals in maintaining defensible tax positions and adapting to regulatory changes while ensuring data privacy.

Accounting Web

IN CASE YOU MISSED IT - TAX STRATEGIES

Exploring tax increases without touching tax rates forms a formidable challenge for the government, bound by pre-election promises. Rebecca Cave considers key strategies for raising revenue, notably tax simplification. One proposal involves a unified tax schedule combining income tax and NIC, and introducing a lower VAT registration threshold with a wealth tax supplanting CGT and IHT. Though these changes could streamline taxation and spur growth, the implementation hurdles, especially harmonising reliefs across income types, cannot be ignored.

Navigating such shifts demands considerable political boldness and resources. The largest obstacle remains employer NIC. Labelling it as employment tax could shift perceptions, but aligning tax periods and thresholds presents further complexities. Scotland's devolved tax powers and varied thresholds complicate matters north of the border. Cave's analysis suggests that starting anew with uniform tax rates might be practical, albeit requiring immense political capital and willpower to press forward.

Accounting Web