- The Modern Accountant

- Posts

- The Modern Accountant Weekly Newsletter | The Impact of Tariff Uncertainty 🌍

The Modern Accountant Weekly Newsletter | The Impact of Tariff Uncertainty 🌍

Plus: The Silicon six $277.8bn tax gap💸

A NEWSLETTER AFFILIATED TO

Welcome to The Modern Accountant, a must-read for entrepreneurial accountants in growing firms. Each week, we share expert insights and practical tips to help you scale your practice, expand advisory services, and embrace new opportunities. Let’s redefine the future of accounting together.

Editors Pick 📣

Where the firms leading the next wave of change will be.

📍30 Golden Square, Soho

📆 22 May | 🕓 4:00–6:30pm

Join senior leaders from top UK firms to discover how to evolve your services, deepen client relationships, and stay ahead.

Packed with insights from new research from Modulr, the event promises to deliver actionable insights on automating the mundane and unlocking opportunities in advisory and fractional CFO services.

Spaces are limited, so request your exclusive invite before it’s too late!

Sector Spotlight 🌟

TRADE POLICY IMPACT

Tariffs introduced by the US, particularly hefty 25% duties on UK cars, steel, and aluminium, are weighing heavily on the UK economy. As a result, the EY Item Club has slashed its growth forecast to just 0.8% for 2025. Consumer confidence has plummeted—only 7% expect any economic improvement—and businesses are tightening belts, wary of increased costs and supply chain disruptions.

What’s interesting amid the gloom is how agile UK businesses are becoming, with nearly a third planning to pivot exports towards Asia, Africa, and Australia. The push for diversification reflects both necessity and ambition, signalling that adaptability could be the key to weathering this storm. The path to recovery looks slow, but the focus on international strategies and collaboration between business and policymakers may well set the stage for future resilience.

INTERNATIONAL TAX COMPLIANCE

From April 2025, employers should take heed of substantial changes to PAYE processes and overseas workdays relief for international staff. The PAYE update allows reduced withholding on UK earnings as soon as notifications are acknowledged by HMRC—no more agonising waits for section 690 approval. Importantly, all previous determinations become invalid, so new annual notifications are essential for affected employees.

On the overseas workdays relief front, the regime now falls under the new foreign income and gains (FIG) system, capping relief at 30% of qualifying income or £300,000 per year. This relief is now only available for the first four years of residence, and eligibility is stricter: no UK residence in any of the previous ten tax years. These developments demand proactive attention and annual updates from employers—ignore them at your peril, as the landscape has fundamentally shifted.

TAX POLICY DEBATE

Big tech giants, known collectively as the Silicon Six, have managed to pay $277.8bn less in tax globally over the past decade, largely by exploiting legal loopholes to secure significantly lower effective tax rates than other profitable companies. For example, Amazon’s tax-to-revenue ratio stands at a mere 1.1%. Despite the introduction of the digital services tax in the UK, these measures barely scratch the surface and face resistance from international trade pressures, particularly from the US government.

While some argue that these corporations contribute through employment and indirect taxation like VAT and national insurance, this omits the fact that most other companies also pay corporation tax in addition. Proposals such as adopting a minimum 15% global tax and increasing transparency through country-by-country reporting are floated as potential solutions, but entrenched political interests and the sheer influence of these tech giants suggest any meaningful reform is unlikely in the near future.

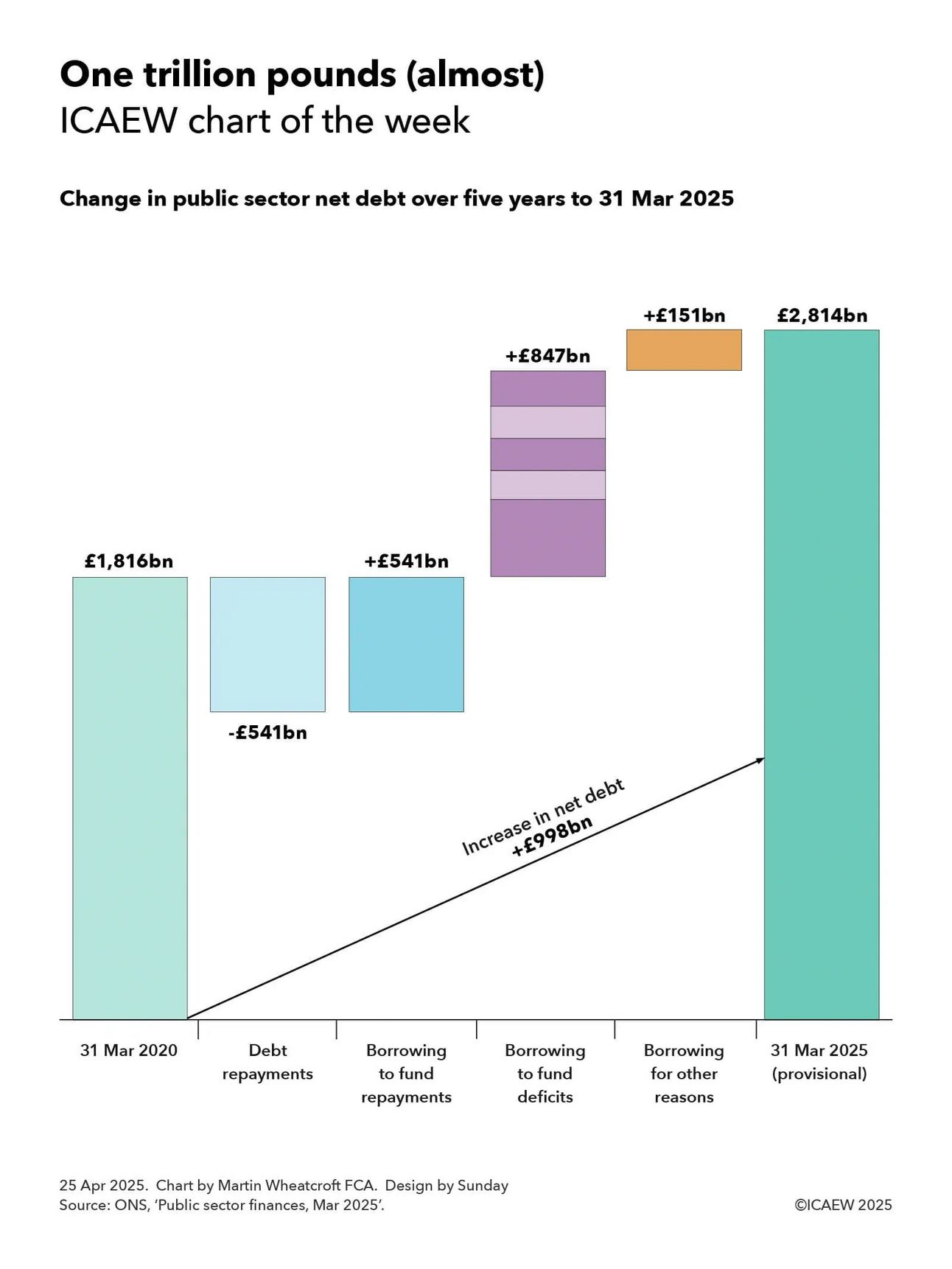

PUBLIC DEBT ANALYSIS

UK public sector net debt has ballooned from £1,816bn to a staggering £2,814bn in just five years, coming within a whisker—just £2bn short—of the symbolic £1tn borrowing mark. This meteoric rise outpaces even borrowing during the aftermath of the financial crisis, with pandemic spending and successive economic shocks pushing borrowing to unprecedented levels.

What’s especially worrying is the persistence of high annual deficits, suggesting that the public purse isn’t tightening as rapidly as planned. As tax burdens edge close to record highs and demographic shifts squeeze the working-age population, the implications for public services are dire—debt interest now nibbles away at resources earmarked for essentials. And, given how minor adjustments can tip debt figures by a few billion, the magnitude feels almost abstract—until we recall how every pound of debt weighs on the nation’s future choices.

TAX POLICY ANALYSIS

Confusing VAT with a tariff misses the mark entirely and risks skewing economic policy, especially in international contexts. Unlike US sales tax, which applies just once, VAT is charged at every point in the supply chain. This design isn’t arbitrary; it helps clamp down on tax evasion by making transactions more visible to authorities. Where President Trump sees VAT as an unfair trade barrier, the reality is more nuanced: VAT discourages both imports and exports, behaving nothing like a tariff.

From a global perspective, the US stands almost alone among developed economies in not implementing VAT. Major countries rely on VAT to sustain government spending, and removing it would force impossible hikes in income tax. Misunderstanding VAT’s true economic impact not only damages trade discussions but could distort broader fiscal strategies. Accurate comprehension here isn’t just academic—it’s vital for sound economic policy.

IN CASE YOU MISSED IT - ACCOUNTING TECHNOLOGY

Agentic AI is shifting the conversation in accountancy by moving beyond robotic process automation—no longer just automating repetitive tasks, but also making decisions, learning from feedback, and taking on multi-step responsibilities with minimal human input. Although current products like Oracle NetSuite’s Financial Exception Management AI and new offerings from Microsoft hint at what’s coming, real end-to-end deployment remains limited, with most firms bolting on chatbots rather than implementing true agentic solutions.

The real draw for practices is clear: cost savings, efficiency, and addressing talent shortages. As AI integrates further, tasks such as handling client enquiries, generating proposals, and managing compliance are on the brink of significant automation. Still, these systems can’t fully replace human judgement, especially where context is key. Trust remains a hurdle, but as AI becomes faster and more reliable, its role in UK accountancy is set to expand rapidly.