- The Modern Accountant

- Posts

- The Modern Accountant Weekly Newsletter | 🔍 UK Economic Slowdown?

The Modern Accountant Weekly Newsletter | 🔍 UK Economic Slowdown?

Plus: 🧠 Tax avoidance vs evasion - where’s the line in 2025?

A NEWSLETTER AFFILIATED TO

Welcome to The Modern Accountant, a must-read for entrepreneurial accountants in growing firms. Each week, we share expert insights and practical tips to help you scale your practice, expand advisory services, and embrace new opportunities. Let’s redefine the future of accounting together.

Editors Pick 📣

As small and medium-sized enterprises (SMEs) face increasingly complex financial landscapes, they need more than just compliance—they need strategic financial leadership. This is where fractional CFOs come in.

Many accounting professionals are stepping into fractional CFO roles, offering part-time, high-level financial guidance that empowers businesses to grow and thrive. If you're considering this career shift, here’s how to make the transition successfully.

In Modulr's latest article, they explore the five key steps to becoming a fractional CFO, including how to:

✔ Expand your expertise in cash flow, forecasting, and business strategy

✔ Build a valuable service portfolio that goes beyond compliance

✔ Leverage automation and payment technology to scale your impact

Ready to take your career to the next level? Check out the full article for more insights.

Sector Spotlight 🌟

ECONOMIC OUTLOOK

The UK's economic outlook remains sombre, marred by stagnation and uncertainty. After a brief recovery in early 2024, growth faltered, with the economy contracting slightly in early 2025. The Bank of England anticipates minimal growth, hindered by policies from the October Budget that have dampened business sentiment. Accountants' confidence plummeted, reminiscent of post-Ukraine invasion levels. This unease is compounded by looming National Insurance and Minimum Wage hikes, prompting concern over potential labour market weakening and restrained business investment.

Consumer sentiment is equally precarious, threatened by rising inflation and higher stamp duties, likely cooling the property market. Adding to domestic woes, global uncertainties, particularly shifting US trade policies under President Trump, challenge stability. Yet, the UK may find some relief in increased public spending and cautious monetary easing by the Bank of England. Despite these measures, the path to invigorated growth seems elusive, necessitating the Chancellor's focus on enhancing competitiveness and productivity for long-term prosperity.

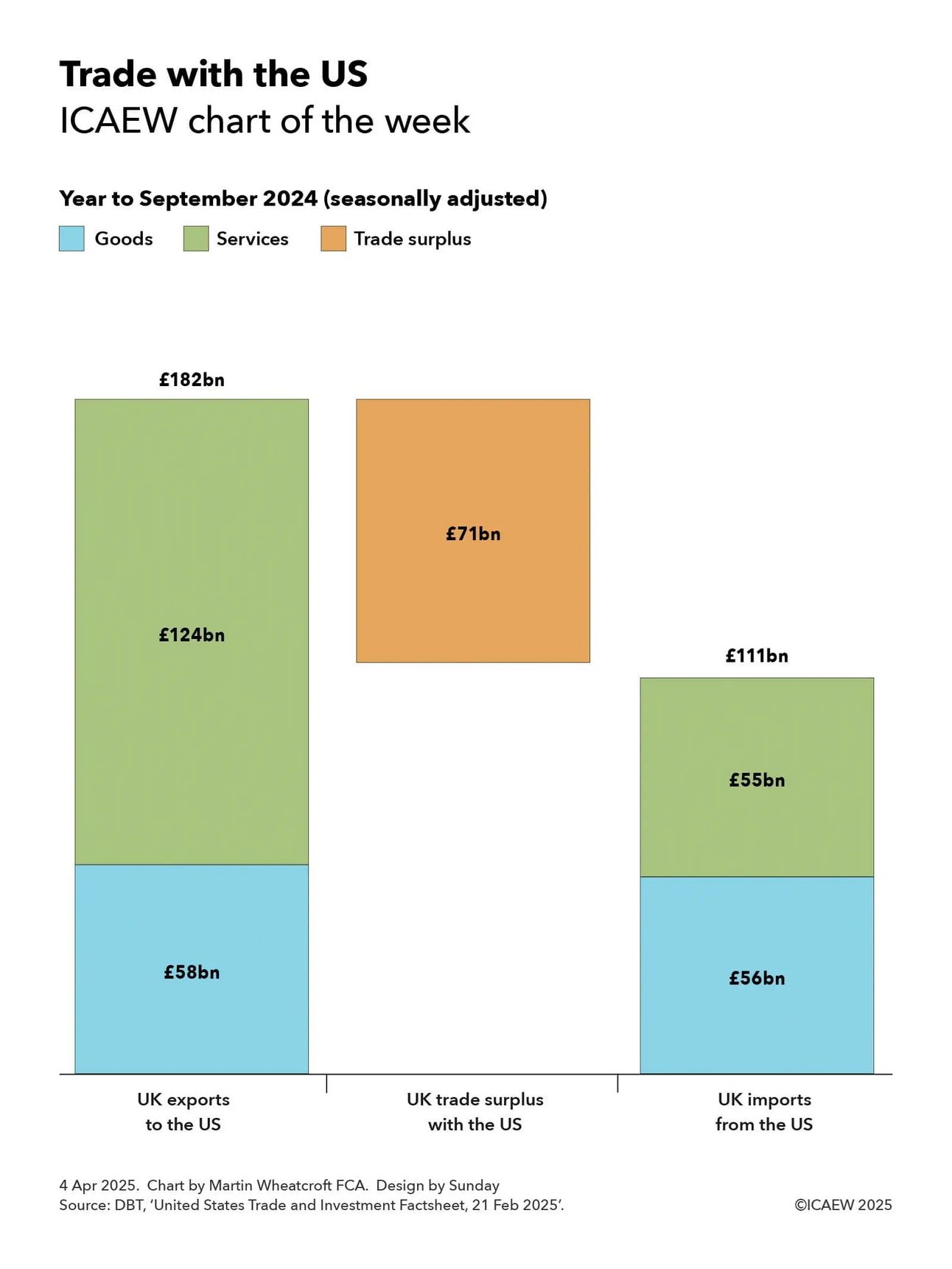

TRADE ANALYSIS

The recent imposition of a 10% tariff on UK exports to the US presents an intriguing dynamic in the trading landscape. Despite this, the UK boasts a noteworthy trade surplus of 71bn for the year ending September 2024, predominantly driven by a significant surplus in services. Interestingly, while the UK claims a modest surplus in goods, the US conversely reports a surplus in its favour, illuminating a particular disparity in statistics that may influence future trade negotiations.

It's essential to note that the US remains the UK's largest single trading partner, accounting for 22% of total UK exports. Goods exports particularly highlight the complexity of this relationship, with manufactured goods such as cars and aircraft representing substantial trade volumes. As the UK navigates these tariffs, the focus remains on preserving its robust services export market, crucial for economic stability in light of a potential global trade war.

ACCOUNTING RANKINGS

Exploring the dynamics of the UK's accountancy landscape, the Top 50+50 Accountancy Firms 2024 showcases the industry's cream of the crop. PwC leads the charge with a remarkable £6,326 million in UK fee income, illustrating a 9% upsurge from the previous year—a testament to its robust market presence. Deloitte follows, holding its ground with a 2.4% boost to £5,700 million, while EY and KPMG remain solidly in the top tier with steady performances. Meanwhile, firms like BDO and Evelyn Partners exhibit commendable growth, suggesting a competitive edge.

Amidst the giants, emerging firms such as Sumer and TC Group make notable entries, climbing the ranks with impressive percentage changes of 605% and 69.1% respectively. This year's rankings, underpinned by voluntary data submissions, celebrate not just the earning power but also the adaptability and ingenuity these firms display in navigating complex financial landscapes. It's an illuminating glance into a sector fuelled by resilience, strategic growth, and the ever-evolving demands of modern commerce.

DIGITAL TAX COMPLIANCE

TaxCalc has released its MTD Quarterly Filer as a bridging tool, aimed at accountants navigating the transition to the Making Tax Digital (MTD) for income tax. This tool enables quarterly submissions from spreadsheets, maintaining existing workflows and integrating seamlessly with other TaxCalc products. Such a tool is essential given the MTD mandate requiring digital record-keeping for those earning over £50,000 annually. It's a technically savvy solution with a drag-and-drop system for spreadsheet data upload and submission to HMRC, streamlining compliance for users.

Accounting professionals can use this tool to manage submissions for various clients and retrieve pertinent information directly from HMRC, effectively improving compliance and data management. Despite being available for free in the first year, the pricing post-MTD rollout remains unspecified. This initiative by TaxCalc exemplifies their commitment to aiding accountants in adapting to digital tax landscapes without causing workflow disruptions, ensuring accountants remain efficient and client-focused amidst regulatory changes.

TAX COMPLIANCE STRATEGIES

Tax avoidance and evasion often tread a fine line, leading to confusion and legal complexities. Philip Fisher's analysis examines the government's latest efforts to tackle tax avoidance schemes. Many accountants defend these practices, claiming their legality. However, Fisher highlights that courts increasingly view many such schemes as illegal, punishing those involved. The distinction is often blurred, particularly with schemes that convert salaries into loans, challenging HMRC's clear legal guidelines.

Addressing these practices could enhance national tax revenue and make life easier for accountants. Promoters and barristers exploit legal loopholes, charging exorbitant fees for schemes that eventually fail, leaving clients with hefty penalties. Fisher suggests cleaning up the tax avoidance industry would not only boost government resources but also protect clients from financial ruin. Ultimately, understanding and refining these distinctions are crucial for developing a transparent tax system that benefits all.

ETHICAL STANDARDS UPDATE

ICAEW has recently updated its Code of Ethics, effective from 1 July 2025, incorporating changes from the International Ethics Standards Board for Accountants (IESBA). These updates are pivotal for accountants, especially in auditing, assurance, and review work. Professionals are reminded of their duty to uphold public interest, maintain an inquisitive mindset, and exercise professional scepticism — crucial in navigating today’s complex business landscape.

The revised code also focuses on technology and professional behaviour. It underscores the importance of handling technological advancements with confidentiality and due care. Moreover, it clarifies independence standards and circumstances under which technology-related non-assurance services may not be provided to clients. The updates address international audit independence standards, albeit with specific UK requirements. The changes are a call for professionals to adapt ethically and competently in an evolving environment, ensuring integrity and public trust in the profession.

IN CASE YOU MISSED IT - TAX POLICY UPDATE

HMRC's decision to increase interest rates for late tax payments, announced during the Autumn Budget 2024, reflects a clear effort to mitigate the growing tax debt. From 6 April 2025, the interest charged on most taxes will rise from 7% to an eye-watering 8.5%, calculated as the Bank of England's base rate plus 4 percentage points, rather than the previous 2.5. Additionally, corporation tax and customs duties will see a similar increase. This move is part of a broader set of measures, including heightened penalties for VAT and for taxes under the Making Tax Digital scheme from April 2025.

These changes are not just about penalising tardiness; they serve an educational purpose too. Companies are encouraged to establish time-to-pay arrangements to avoid the hefty 10% daily penalty on VAT underpayments. The HMRC’s intention seems to be driving businesses towards responsible financial planning. While the prospect of stiffer penalties might seem daunting, viewing this as a nudge towards better fiscal discipline might just turn a financial pitfall into an opportunity for improved financial health.